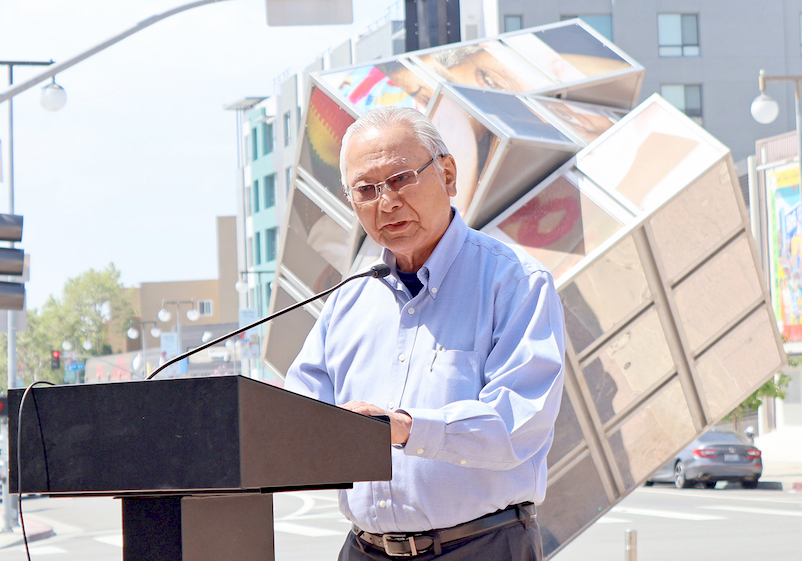

Bill Watanabe, pictured here at last year’s news conference where Little Tokyo was named to the 11 Most Endangered Historic Places list. (Photo: George Toshio Johnston)

One giant leap for self-determination in Little Tokyo?

By George Toshio Johnston, P.C. Senior Editor

The future of Little Tokyo may have taken a game-changing turn for the better earlier this month when the Little Tokyo Community Impact Fund purchased a 120-year-old building at 321-323 E. First St. for $3.8 million.

It was the culmination of several events: the timing of a rare opportunity to buy a Little Tokyo property that presented itself just as a new approach for saving small businesses was in place and ready to act; recent changes in state laws as they apply to business entities; and perhaps most significantly, a new mindset.

Related stories:

Fourth & Central Plans Spark Concern

Little Tokyo Recalls Its Past for the Future

A First Small Step Before a Giant Leap

4th & Central Opponents Hit Obstacle

Key to the new approach was the foundation of the Little Tokyo Community Impact Fund, a REIT, or real estate investment trust, formed as a social purpose corporation or SPC, which is essentially a hybrid between a nonprofit corporation and a for-profit corporation, meaning it can serve a purpose usually reserved for nonprofits, but also make a profit — but without profit maximization serving as its sole purpose, due to having a larger societal objective.

Or, as LTCIF board president Bill Watanabe put it, quoting someone he was explaining the LTCIF concept to, who said, “Well, that sounds like a charitable for-profit.”

The recent changes in state law, meantime, date back to the 2011 creation of a new category of business entity, the flexible purpose corporation, which in 2015 became known as a social purpose corporation.

As such, the LTCIF serves as an investment vehicle for community-minded people interested in helping keep Little Tokyo-based businesses from closing or being forced to move by being at the mercy of property owners more interested in maximizing profits by increasing the rent, and less in maintaining and sustaining the shops, restaurants and services that help define the character of Little Tokyo.

As for the new mindset, it could be boiled down to this: Don’t fight the landlord; become the landlord.

Watanabe, whose decades-long association with the Little Tokyo Service Center included serving as its executive director until his 2012 retirement, told the Pacific Citizen that the birth of the LTCIF came about a few years ago, prepandemic, when “a group of us were thinking: ‘What can we do to fight off gentrification?’”

After kicking around several ideas, the core group that would go on to form the LTCIF thought that “maybe we could form an investment fund, but instead of paying high dividends and top dollar returns, suppose we kept some of it back to help subsidize small business rents?”

The timing was right because California had recently created a new type of business entity, the social purpose corporation. It gets better. Watanabe called Little Tokyo unique for being able to “attract investors who loved the neighborhood enough to invest money.”

With two investment tiers —$1,000 and $10,000 — the formation of the LTCIF to create a REIT became a “put your money where your mouth is” proposition. Watanabe, who realized he “had money parked in a couple of CDs,” did just that.

Acknowledging that investment involves risk, including possibly losing the money one has invested, Watanabe said, “We let people know it’s not like a donation because once you give a donation, that’s it. But with an investment, technically, you could get it back. It’s like any other stock investment. You put money in, you can also take it out.

“We do tell people, ‘Don’t put your retirement money in here. Don’t put your kids scholarship money in here.’ This is money that you can afford to lose because in a worst-case scenario, something bad could happen,” he said.

The LTCIF did manage to raise $900,000, according to Watanabe. But it was not enough to buy the building at 321-323 E. First St. Would it be a repeat of when, in an earlier attempt to purchase property in Little Tokyo — the old Uyeda building — the LTCIF was outbid at the last second?

The Little Tokyo Community Impact Fund recently purchased the building that houses businesses located at 321-323 E. First St. According to LTCIF’s Bill Watanabe, the second floor may someday be rented out as office space. (Photo: George Toshio Johnston)

Fortunately, no, thanks to a foundation, the name of which Watanabe could not reveal, which covered the balance owed and allowed this purchase to succeed — and hopefully be the beginning of more to come.

“We were lucky to get this foundation, but it’s an ideal thing because we bought the property, and now it’s mortgage free,” he said.

Watanabe was sanguine about what this means for now. “One building is not going to have a huge impact,” he said. “But if we can leverage the property so that maybe when a property will come up for sale, we can do another and then another, and then another. Then pretty soon, if you have four or five properties, you can now have enough commercial places to be able to help a lot of businesses.”

But — and there is always a “but” — the LTCIF’s success in having purchased the building means dealing with problems that come with being the landlord.

“About two days after we closed escrow, I get a call from one of the commercial businesses saying the trash didn’t get kept up today. So, I’m thinking, ‘Oh my gosh, what have I done? What have I got? A little buyer’s remorse? Now we’ve got to worry about this stuff.”

In the bigger scheme of things for the future of Little Tokyo, maybe being the landlord is a good problem to have.

To learn more about the Little Tokyo Community Impact Fund, visit littletokyocif.com/.